how is capital gains tax calculated in florida

Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held. The first thing you need to know about capital gains tax is that they come in two flavors.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Long-term capital gains tax on stocks.

. FairTax was a single rate tax proposal in 2005 2008 and 2009 in the United States that includes complete dismantling of the Internal Revenue Service. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. Up to 9875 is taxed at 10 under normal rates with no long-term capital gains tax.

40126 to 85525 is taxed at 22 and long-term capital gains of 15 apply. In the United States of America individuals and corporations pay US. Offsetting capital gains with losses.

The California capital gains tax is calculated by taking the sale price. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. 85526 to 163300 is taxed at 24 with long term capital gain tax of 15.

No state capital gains tax. With this tactic you can use up to 3000 in realized losses from your investments to offset capital gains of a similar type of investment. Between 9876 and 40125 is taxed at 12 with no long-term capital gains tax.

The proposal would eliminate all federal income taxes including the alternative minimum tax corporate income taxes and capital gains taxes payroll taxes including Social Security and Medicare taxes gift taxes and estate taxes.

How High Are Capital Gains Taxes In Your State Tax Foundation

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

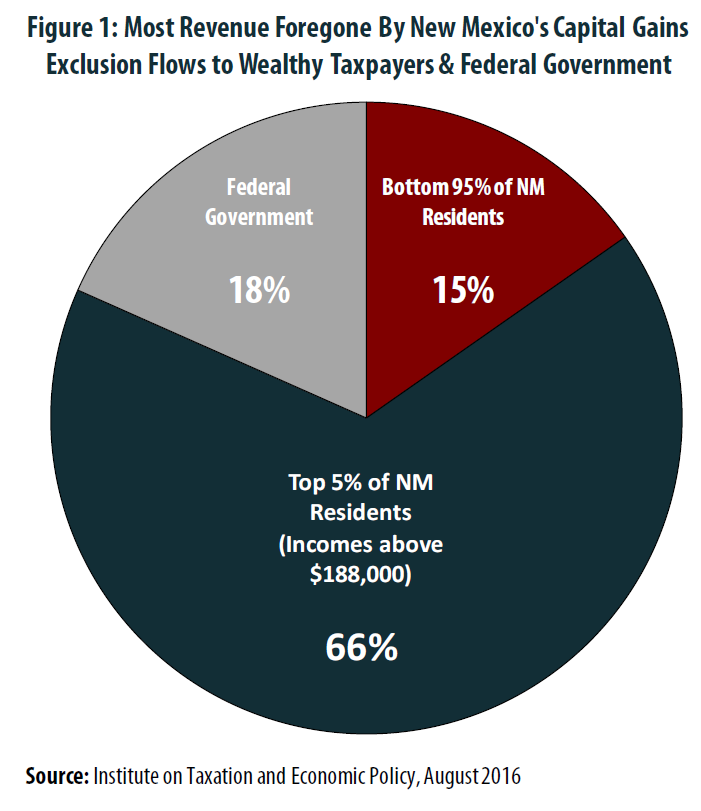

The Folly Of State Capital Gains Tax Cuts Itep

The States With The Highest Capital Gains Tax Rates The Motley Fool

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Calculator 2022 Casaplorer

Florida Real Estate Taxes What You Need To Know

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Tax What Is It When Do You Pay It

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains On Selling Property In Orlando Fl

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses